| The e-Invoicing system is a significant step forward for the Malaysian government’s digitalization agenda. It is expected to have a positive impact on the economy and help to improve the efficiency of the tax system. The e-Invoicing system is designed to improve the efficiency and transparency of the invoicing process. It will also help to reduce tax evasion and fraud. |

| |

What Is E-Invoicing?

|

| E-Invoicing is not a human-readable PDF invoice. It is a machine-readable format. Malaysia LHDN e-Invoicing only accepts machine-readable XML, JSON files, not PDF, DOC, JPEG, or email. |

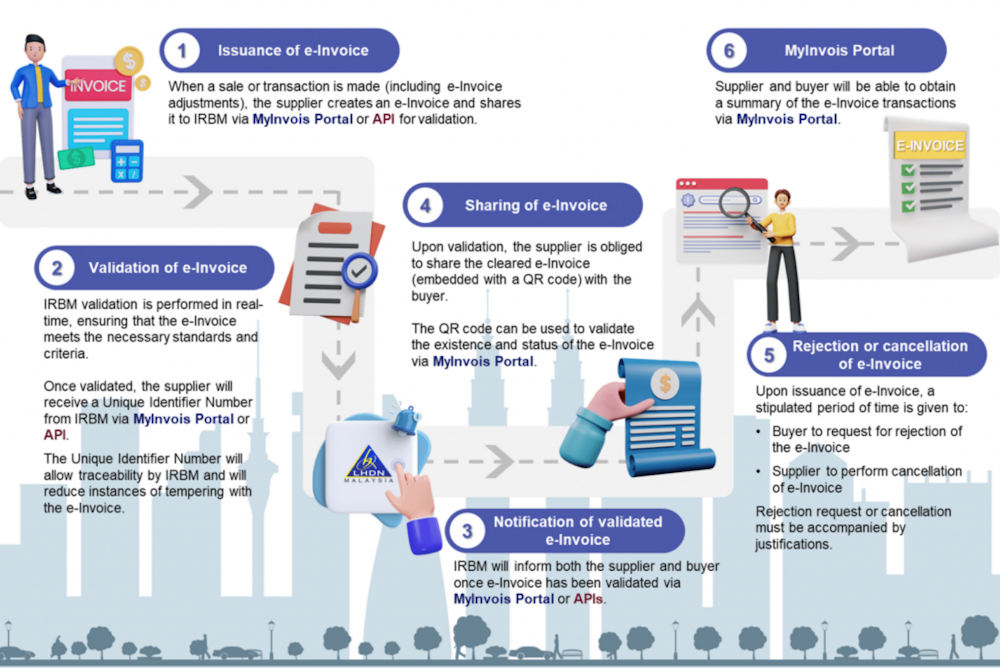

| Every invoice must be sent to LHDN for approval and validation by the Inland Revenue Board (IRB) before it can be printed as a verified invoice for your customer. IRBM will validation includes TIN and e-Invoice data structures / format. Upon validation of the e-Invoice, the supplier is obliged to share the cleared e-Invoice with the buyer after embedding the validated link (provided by IRBM) in a form of QR code on the e-Invoice. The QR code can be used to validate the existence and status of the e-Invoice via MyInvois Portal. |

| |

How Long Does E-Invoicing Validation Take?

|

| Refer to the IRBM e-Invoice guideline version 1.0, IRBM will develop the Continuous Transaction Control (CTC) Model where the validation is done instantly (or near-instantly) by IRBM. |

| |

|

| |

Who Are Required To Implement E-Invoicing?

|

| Any business voluntarily to adopt e-Invoicing with LHDN Malaysia will be effective from 1 January 2024. The mandatory implementation will be based on turnover or revenue thresholds and will be implemented in phases starting from 1 June 2024. However, taxpayers are welcome to implement e-Invoice at an earlier phase voluntarily. The implementation details are as follows: |

| |

| Phase |

Budget 2024 Announcement |

Annual Turnover / Revenue |

| 1 |

01 August 2024 |

> RM100 million |

| 2 |

01 January 2025 |

> RM50 million |

| 3 |

01 January 2025 |

> RM25 million |

| 4 |

01 July 2025 |

All tax payers and some non-business transactions |

|

|

| |

What Information Will Be Store In IRBM Database?

|

| Every invoice issued must include the following information, which will be stored in the IRBM Database. This information is required to ensure the authenticity, integrity, and traceability of e-Invoices. It possible also used by the tax authorities to verify the accuracy of tax returns. |

| |

- General Information:

This includes the invoice number, e-Invoicing type, e-Invoicing purpose, e-Invoicing date (current date)

- Supplier & Customer Information:

This includes the supplier and customer’s TIN, name, address, email address, 5 digit MSIC code, MSIC description, website, contact person, and contact number, company registration number/individual myKad number/passport, SST registration number, currency, exchange rate

- Item Information:

This includes the description, quantity, uom, unit price, discount rate, discount amount, tax type, tax code, tax rate, and tax amount, tariff code, subtotal, total excluding tax, total including tax for each item on the invoice

- Validation Information:

This includes the IRBM Unique Identifier Number, validation date and time, and validation status of the invoice

- Digital Certificates / Signature:

Digital Certificates will be issued to taxpayers to enable them to attach digital signatures to e-Invoices. The digital signature will verify that the submitted e-Invoice data originates from a specific taxpayer

- Additional Information (Optional):

This may include payment mode, supplier bank account, payment terms, payment amount, payment date, payment reference number, bill reference number, and other relevant information

|

| |

What Is TIN Number?

|

| A TIN number in Malaysia is a Tax Identification Number, also known as Nombor Pengenalan Cukai. It is a unique number assigned to individuals and entities registered as taxpayers with the Inland Revenue Board of Malaysia (IRBM). The TIN number is used by the IRBM to identify taxpayers and track their tax records. It is also utilized by the IRBM to monitor taxpayer compliance and detect tax evasion. |

|

| The Inland Revenue Board of Malaysia (LHDN) has announced an update to the format of Tax Identification Numbers (TINs) for Malaysian taxpayers. The new format will be effective from January 1, 2023. |

|

| The old TIN format was a 12 or 13-digit number, with the first one or two letters indicating the type of taxpayer, such as “SG” for individual residents or “C” for companies. The remaining digits constituted a unique identifier for the taxpayer. |

|

| The new TIN format will consist of a 13-digit number. The first two letters will be “IG,” which stands for “Individual taxpayer.” The remaining 11 digits will remain the same as the old TIN number. Here’s how to check your TIN number online. |

|

| For more information about the new TIN format, please visit the LHDN website. |

|

| |

| The e-Invoicing system will be mandatory for businesses with a turnover of RM100 million or more effective June 2024. It will be rolled out to all businesses in January 2027. |

| |

| This article discusses the amendment of e-invoices in Malaysia. A crucial aspect of this amendment is the 72-hours grace period, which allows businesses to make adjustments to their e-invoices within 72 hours of issuing the original invoice. This grace period can be used to rectify any errors or discrepancies in the invoice. It is important for businesses operating in Malaysia to understand how this grace period works and how to utilize debit notes and credit notes in order to maintain accurate and compliant invoicing practices. |

| |

| Here is a more detailed explanation of the 72-hours e-Invoicing grace period: |

- Businesses can reject or request cancellation of an e-invoice within 72 hours of issuing the original invoice.

- After this period, modifications to e-invoices are not allowed.

- If any changes are required after 72 hours, businesses must issue a new invoice, debit note, credit note, or refund.

- It is important to maintain clear records of these adjustments and follow the relevant regulations to ensure compliance with the IRB’s guidelines.

|

| |

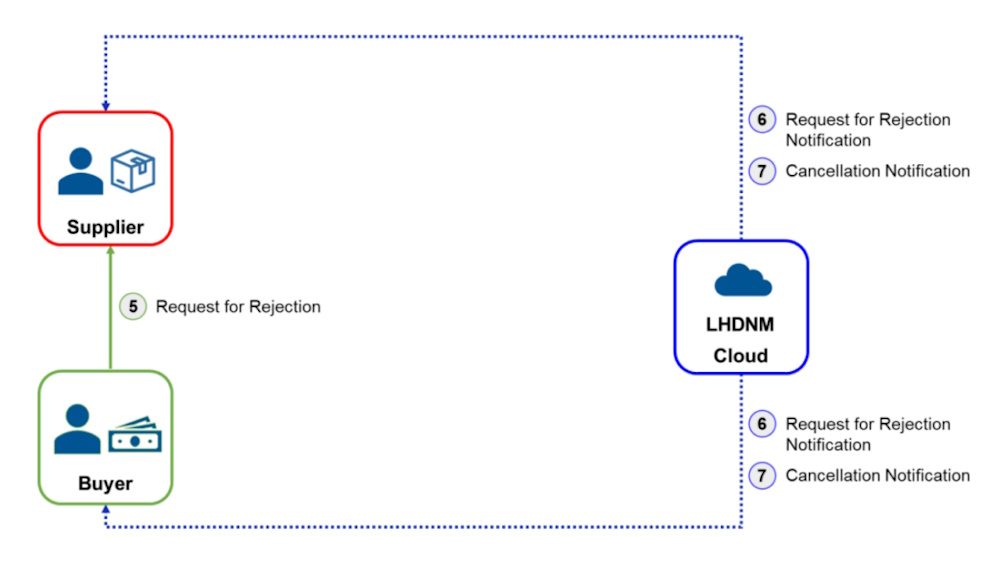

| Buyer Requests Rejection: |

- Within 72 hours of receiving an e-invoice, the buyer can request its rejection.

- When buyer initiating rejection request, the seller will receive a notification.

- The seller must approve the buyer’s request for rejection before the e-invoice can be cancelled.

- If the seller does not approve the buyer’s request for rejection, the e-invoice will automatically be considered valid after 72 hours.

|

| |

| Seller Perform Cancellation: |

- The seller can also initiate a cancellation of the e-invoice within 72 hours.

- If the seller cancels the e-invoice, the buyer will no longer be required to pay the amount stated on the invoice.

- After 72 hours, the e-invoice will automatically be considered valid.

- Any further amendments to the e-invoice will require a debit or credit note.

|

|

|

| |

SQL Accounting Software: The E-Invoicing Solution That Will Make Your Life Easier

|

|

|

| As a business operating in Malaysia, it is essential to start your preparations for the upcoming e-Invoicing system. SQL Accounting Software, the best Accounting Software in Malaysia with trusted by more than 270,000 companies. |

|

| Our extensive experience in handling complex GST matters ensures a seamless and automated GST function for our clients. Even without accounting or tax expertise, our automation system empowers users to comply effortlessly with the rules. |

|

| SQL Account presents the ideal solution, providing user-friendly, reliable, and secure e-Invoicing software. Take the proactive step and reach out to us today to unveil how SQL Account can aid you in adhering to e-Invoicing regulations in Malaysia, propelling your business efficiency to unparalleled heights. |

| |

Top 5 Questions Asked About E-Invoicing

|

| Can e-Invoices be cancelled after submit to LHDN? |

|

| Yes, e-Invoices can be cancelled within 72 hours of issuance. To cancel an e-inovice. the supplier / customer must submit a cancellation / rejection request to buyer / seller within 72 hours via MyInvois Portal. |

|

| |

| Does e-invoice allowed for editing of information after verified by LHDN? |

|

| No, the supplier would need to cancel the e-invoice (Refer Q1) and reissue another new e-invoice. |

|

| |

| What details are needed for an e-invoice cancellation / rejection request? |

|

| The cancellation / rejection request should specify the reason, which can include incorrect invoice data in any field (e.g., SST number, business registration number, any business-related information, etc). |

|

| |

| What if the seller/buyer doesn’t approve my request for amendment / cancellation? |

|

| After the 72-hours timeframe, the status of the e-Invoice will automatically change to “Valid”, and any further amendments will require a Debit/Credit Note. |

|

| |

| Can I extend the time to adjust an e-invoice? |

|

| No, as per IRBM guidelines, there is a 72-hours timeframe for rejection / cancellation of e-invoice. If this time is exceeded, any adjustments will require the issuance of a new invoice, debit note, credit note, or refund. |

|

| |

| Malaysia LHDN aims to enforce mandatory e-Invoicing adoption for 4,000 businesses by June 2024, concerning those with an annual turnover of RM 100 million! Furthermore, starting from January 2027, e-Invoicing will become compulsory for all businesses, regardless of their sales threshold. According to the guidelines provided by the Malaysian Inland Revenue Board (IRB) in version 1.0 of the e-invoice guideline, businesses in Malaysia have two ways to upload and sync their invoices to the government platform: |

| |

Adoption of Accounting Software with compliance with IRB Malaysia

|

|

|

| One of the ways to comply with the e-Invoicing mandate is by adopting accounting software that is designed to be compatible with the IRB Malaysia API’s (Application Programming Interface) guide. Specifically, businesses can opt for accounting software solutions such as SQL Accounting software, which is certified to meet the IRB’s requirements. |

|

| With this method, businesses can streamline the process of e-invoice submission. Once an invoice is issued through the SQL Accounting software, there will be a convenient and straightforward option available to users. By simply clicking a designated button, the invoice can be directly and automatically synced to the government’s e-Invoicing platform. This approach saves time and effort for businesses, ensuring efficient and real-time submission of invoices to the IRB. |

| |

Manual Submission to myInvois Portal for Batch Submission

|

|

|

| For businesses that do not have or prefer not to use compatible accounting software, the IRB provides an alternative option for manual submission. This method involves utilizing the myInvois portal, which is designated for e-invoice submission manually. |

|

| Businesses following this route would manually prepare their invoices in a format compliant with the IRB’s guidelines. Each of the invoicing are required to fill up manually for up to 53 fields. After preparing the invoices, they can be submitted to the myInvois portal for batch submission. The portal is for businesses to upload multiple invoices in one go. |

| |

Which Method Best Suits Your Needs?

|

| It’s crucial for businesses to carefully assess their needs and capabilities before choosing either method of e-invoice submission. Those with appropriate accounting software, like SQL Accounting software, can leverage the integration with the government platform to the and ensure timely compliance with the e-Invoicing mandate. On the other hand, businesses without compatible software can opt for manual submission through the myInvois portal, ensuring they fulfill their obligation to submit e-invoices to the IRB in practical manner. However, it is important to aware if any manual mistakes, mean resulted a high-cost penalties. |

|

| For manual submission of e-invoices, there are up to 53 fields that need to be filled up. These fields are required by the Malaysian Inland Revenue Board (LHDN) to ensure that all e-invoices are properly validated. If any errors are detected during validation, the e-invoice will be rejected and an error message will be displayed. The supplier will then need to correct the errors and resubmit the e-invoice. |

| |

| Examples of e-Invoice Required Fields: |

| Field Name |

Description |

| Supplier's TIN |

Supplier’s (i.e., issuer’s) TIN assigned by IRBM |

| Buyer's TIN |

Buyer’s TIN assigned by IRBM |

| Supplier’s Registration / Identification Number / Passport Number |

For businesses: Business registration number

For Malaysian individual: MyKad identification number

For non-Malaysian individual: Passport number |

| Buyer’s Registration / Identification Number / Passport Number |

For businesses: Business registration number

For Malaysian individual: MyKad identification number

For non-Malaysian individual: Passport number |

| e-Invoice Code / Number |

Document reference number used by supplier for internal tracking purpose (e.g., INV12345, CN23456, DN34567) |

| e-Invoice Date |

Date of issuance of the e-Invoice

*Note that the date must be the current date |

| Description of Product or Service |

Details of products or services being billed as a result of a commercial transaction |

| Tax Type |

Type of taxes that will be applicable (SST and / or withholding tax) |

| Tax Rate |

The appropriate tax rate that is applicable (%) |

| Tax Amount |

The amount of tax payable |

| Total Excluding Tax |

Sum of amount payable exclusive of applicable taxes (e.g., sales tax, service tax) |

| Total Including Tax |

Sum of amount payable inclusive of total taxes chargeable (e.g., sales tax, service tax) |

|

|

| Check LHDN e-Invoice Guideline for all 53 required fields. |

|

| It is important to ensure that all e-invoices are correctly filled up with up to 53 required fields. This can be done by using accounting software that can automatically fill in the required information. This will help to prevent errors and ensure that the e-invoices are validated smoothly. |

|

| As the leading accounting software in Southeast Asia, SQL Accounting software stands as the top choice, fully aligned with SST and e-Invoicing regulations. To support Malaysia’s SME businesses, SQL is thrilled to offer a complimentary e-Invoicing module alongside every new acquisition of SQL Accounting software. This module comes at absolutely no cost until the year 2028. This exclusive offer is limited to the first 2000 customers. Reach out to us now to secure your spot for a FREE demo with SQL. Elevate your business efficiency and ensure seamless compliance with Malaysia’s e-Invoicing standards. Don’t miss this chance to propel your business to new heights! |